[WITHDRAWN] Deep Reinforcement Learning for Tehran Stock Trading

Abstract

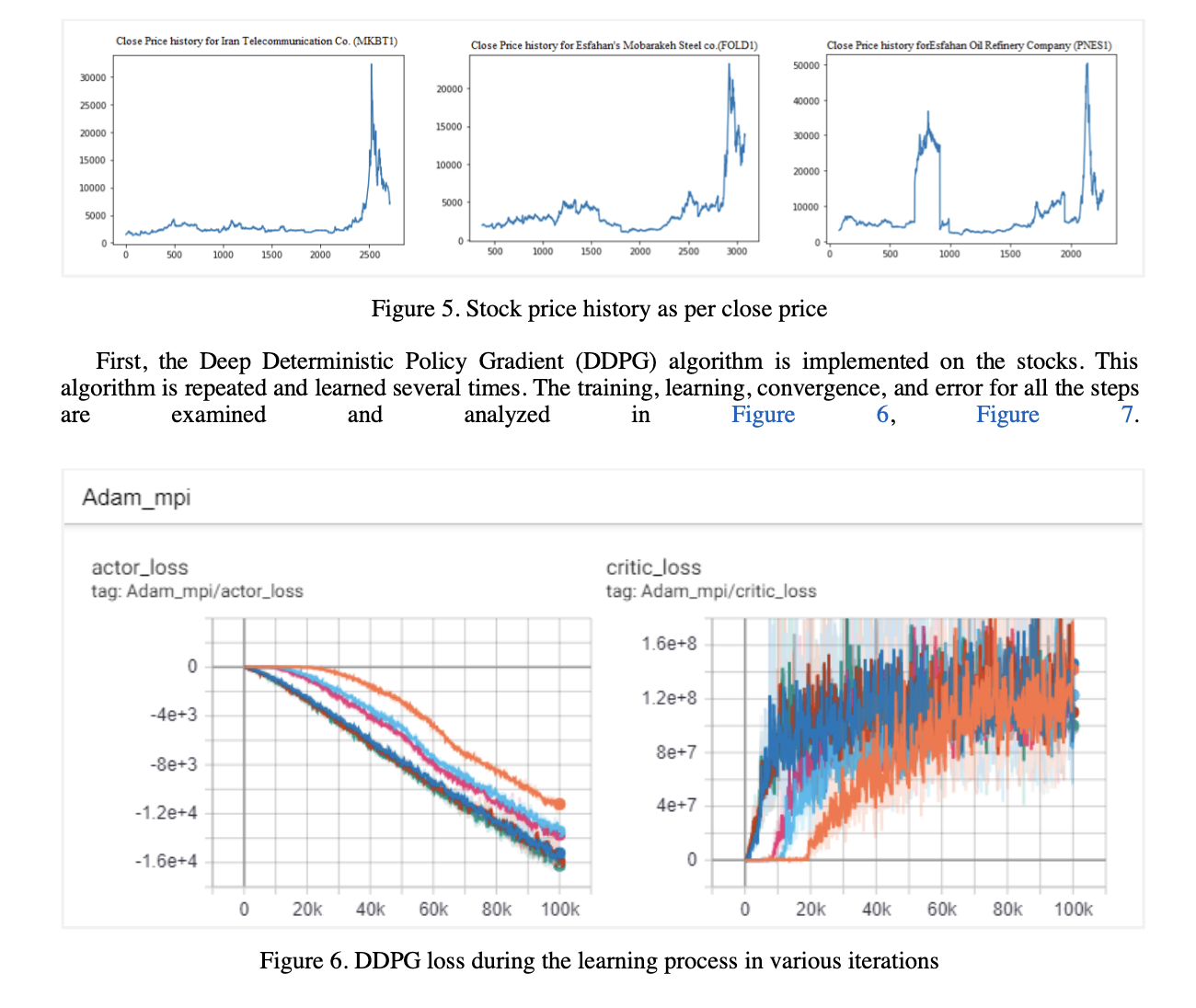

One of the most interesting topics for research and also for making a profit is stock trading. Artificial intelligence has had a great impact on this path. A lot of research has been done to investigate the application of machine learning, and deep learning methods in stock trading. Despite the large amount of research done in the field of prediction and automation trading, stock trading as a deep reinforcement-learning problem remains an open research area. The progress of reinforcement learning as well as the intrinsic properties of reinforcement learning make it a suitable method for market trading in theory. In this paper, single stock trading models are presented based on the fine-tuned state-of-the-art deep reinforcement learning algorithms (Deep Deterministic Policy Gradient (DDPG) and Advantage Actor Critic (A2C)). These algorithms are able to interact with the trading market and capture the financial market dynamics.

The proposed models are compared, evaluated, and verified on historical stock trading data. Annualized return and Sharpe ratio have been used to evaluate the performance of proposed models. The results show that the agent designed based on both algorithms is able to make intelligent decisions on historical data. The DDPG strategy performs better than the A2C and achieves better results in terms of convergence, stability, and evaluation criteria.

Downloads

References

Fischer, T.G., 2018. Reinforcement learning in financial markets-a survey (No. 12/2018). FAU Discussion Papers in Economics.

Wang, Y., Wang, D., Zhang, S., Feng, Y., Li, S. and Zhou, Q., 2017. Deep Q-trading. cslt. riit. tsinghua. edu. cn.

Deng, Y., Bao, F., Kong, Y., Ren, Z. and Dai, Q., 2016. Deep direct reinforcement learning for financial signal representation and trading. IEEE transactions on neural networks and learning systems, 28(3), pp.653-664.

Moody, J. and Saffell, M., 2001. Learning to trade via direct reinforcement. IEEE transactions on neural Networks, 12(4), pp.875-889.

Li, Y., Zheng, W. and Zheng, Z., 2019. Deep robust reinforcement learning for practical algorithmic trading. IEEE Access, 7, pp.108014-108022.

Silver, D., Lever, G., Heess, N., Degris, T., Wierstra, D. and Riedmiller, M., 2014, January. Deterministic policy gradient algorithms. In International conference on machine learning (pp. 387-395). PMLR.

Lillicrap, T.P., Hunt, J.J., Pritzel, A., Heess, N., Erez, T., Tassa, Y., Silver, D. and Wierstra, D., 2015. Continuous control with deep reinforcement learning. arXiv preprint arXiv:1509.02971.

Xiong, Z., Liu, X.Y., Zhong, S., Yang, H. and Walid, A., 2018. Practical deep reinforcement learning approach for stock trading. arXiv preprint arXiv:1811.07522.

Mnih, V., Badia, A.P., Mirza, M., Graves, A., Lillicrap, T., Harley, T., Silver, D. and Kavukcuoglu, K., 2016, June. Asynchronous methods for deep reinforcement learning. In International conference on machine learning (pp. 1928-1937). PMLR.

Sutton, R.S. and Barto, A.G., 2011. Reinforcement learning: An introduction.

Fischer, T.G., 2018. Reinforcement learning in financial markets-a survey (No. 12/2018). FAU Discussion Papers in Economics.

Silver, D., Hasselt, H., Hessel, M., Schaul, T., Guez, A., Harley, T., Dulac-Arnold, G., Reichert, D., Rabinowitz, N., Barreto, A. and Degris, T., 2017, July. The predictron: End-to-end learning and planning. In International Conference on Machine Learning (pp. 3191-3199). PMLR.

Mnih, V., Kavukcuoglu, K., Silver, D., Rusu, A.A., Veness, J., Bellemare, M.G., Graves, A., Riedmiller, M., Fidjeland, A.K., Ostrovski, G. and Petersen, S., 2015. Human-level control through deep reinforcement learning. nature, 518(7540), pp.529-533.

Konda, V. and Tsitsiklis, J., 1999. Actor-critic algorithms. Advances in neural information processing systems, 12.

Vitay, J., 2020. Deep Reinforcement Learning.

Cooper, I., 1996. Arithmetic versus geometric mean estimators: Setting discount rates for capital budgeting. European Financial Management, 2(2), pp.157-167.

Abadi, M., Barham, P., Chen, J., Chen, Z., Davis, A., Dean, J., Devin, M., Ghemawat, S., Irving, G., Isard, M. and Kudlur, M., 2016. Tensorflow: A system for large-scale machine learning. In 12th {USENIX} symposium on operating systems design and implementation ({OSDI} 16) (pp. 265-283).

Brockman, G., Cheung, V., Pettersson, L., Schneider, J., Schulman, J., Tang, J. and Zaremba, W., 2016. Openai gym. arXiv preprint arXiv:1606.01540.

https://stable-baselines.readthedocs.io/

Yang, H., Liu, X.Y., Zhong, S. and Walid, A., 2020, October. Deep reinforcement learning for automated stock trading: An ensemble strategy. In Proceedings of the First ACM International Conference on AI in Finance (pp. 1-8).

Copyright (c) 2022 Indonesian Journal of Data and Science

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.

License and Copyright Agreement

In submitting the manuscript to the journal, the authors certify that:

- They are authorized by their co-authors to enter into these arrangements.

- The work described has not been formally published before, except in the form of an abstract or as part of a published lecture, review, thesis, or overlay journal.

- The work is not under consideration for publication elsewhere.

- The work has been approved by all the author(s) and by the responsible authorities – tacitly or explicitly – of the institutes where the work has been carried out.

- They secure the right to reproduce any material that has already been published or copyrighted elsewhere.

- They agree to the following license and copyright agreement.

Copyright

Authors who publish with Indonesian Journal of Data and Science agree to the following terms:

- Authors retain copyright and grant the journal right of first publication with the work simultaneously licensed under a Creative Commons Attribution-NonCommercial 4.0 International License. (CC BY-NC 4.0) that allows others to share the work with an acknowledgement of the work's authorship and initial publication in this journal.

- Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the journal's published version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgement of its initial publication in this journal.

- Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work.